Hello my Investors, Traders and Reader Friends. The market came back up yesterday. The DJ-30 closed above the 13,000 points for the first time since 2008. However, there was not a spectacular day. The volume of shares traded and volatility remained very low. But what surprised me was the small number of stocks showing good price patterns. One of these was Dominos Pizza Inc. (DPZ). This stock climbed more than 15% yesterday, closing at US$ 38.82. Its volume was 5.82 Millions of shares, nine times the amount traded daily. The Market cap of this company is US$ 2.26 Billions, its P/E is 24.56 and its EPS is 1.58. DPZ has 58.20 Millions of shares, of which 88% is owned by institutional investors. Yesterday, Dominos did a pretty good break and now is heading up.

Stock Picks: Portfolios Update

Yesterday, our two portfolios benefited from the rise of the market. However, the stock investment requires a clear strategy in function of the objectives pursued. Thus, our Short Term Growth Portfolio (STGP) has a different strategy than the Medium Term Growth Portfolio (MTGP). In both cases, profits that are obtained are still very Attractive. In addition, management is very easy. Just follow the instructions to publish on this blog daily. Thus, this day has been included in the STGP a new stock. This stock is RPC Inc. (RES). It has opened a short position with the stock at closing price on Tuesday.

Jim Rogers: Play This Rally With Commodities

CNBC

By: Michelle Fox

The Dow and S&P 500 may have hit their highest levels since 2008 on Tuesday, but Jim Rogers , CEO and Chairman of Rogers Holdings, is still staying away from stocks. Instead, he told “The Kudlow Report” he’s playing the rally with commodities.

|

MIKE CLARKE | AFP | Getty Images |

“You see what’s happening to gold … Oil went down today, yes, but oil’s been going through the roof,” he said. “There are other ways to play. They’re printing a lot of money, Larry. When they print money, you have to protect yourself with real assets in the end.”

Rogers says things are “fine” right now because it’s an election year, not only in the U.S. but around the world, and that means governments are spending and printing money. It’s the future he’s concerned about.

“Worry about 2013. Be panicked bout 2014,” Rogers said. “But this year a lot of good news is coming out.”... read more.

EU Leaders Say They Are Taking Steps to Restore Growth While Paring Debt

Bloomberg

European Union leaders are “taking all necessary measures” to restore growth while also paring excessive debt, according to a draft EU summit statement.

Countries drawing on aid or under “market scrutiny” must abide by budget targets while better-off countries “should let automatic stabilizers operate fully,” said the draft of the statement to be released at the end of a March 1-2 summit in Brussels.

Europe has made “insufficient” progress on targets for research, employment, climate change, education and social inclusion, the draft said. It called for “more precise, operational and measurable commitments.”

The statement echoed prior warnings that banks strengthen their capital positions “without excessive deleveraging.”

It set a June target for launching a “project bond” initiative that will guarantee some new bonds sold for energy and transport projects.

To contact the editor responsible for this story: James G. Neuger at jneuger@bloomberg.net

Tips & News

German Jobless Rate Holds at Lowest in Two Decades as Economy Strengthens

German jobless rate up to 7.4 pct in February

German jobless rate up to 7.4 pct in February

Apple to Unveil New IPad Next Month

Grantham Advises Investors To Sidestep Surging S&P 500

Semiconductor stocks drive Nasdaq rally

5 Silver Stocks To Watch

It's Time To Invest In Diamonds

Asia Faces Sugar Deficit as Gains in Demand Outstrip Supply, McNeill Says

Trucks Run on Natural Gas in Pickens Clean Energy Drive

Dennis Gartman Sells Crude, Likes Natural Gas

Grantham Advises Investors To Sidestep Surging S&P 500

Semiconductor stocks drive Nasdaq rally

5 Silver Stocks To Watch

It's Time To Invest In Diamonds

Asia Faces Sugar Deficit as Gains in Demand Outstrip Supply, McNeill Says

Trucks Run on Natural Gas in Pickens Clean Energy Drive

Dennis Gartman Sells Crude, Likes Natural Gas

Free Stock Picks with Down Trend: APKT -DV - ANR

On Tuesday, the market closed with widespread gains. It is not easy to find hot stock picks to take short positions. Our daily stock picks system found some candidates. They are not as good as in previous days. However, they can be considered as potential shorts. Remember, those stocks always fall faster than they rise. So, have some short positions in a portfolio can be very healthy. All stocks that we include in this list, have the conditions to be considered for short positions. Next, you will find three "hot stock picks", three good candidates for short positions.

Acme Packet Inc. (APKT).- Price: US$ 32.32 (Var: -4.66%). Volume: 3.01 Millions of shares (daily MA: 3.65M). Good fall but its oversold. Will Acme Packet disappoint Analysts next Quarter?

Devri Inc. (DV).- Price: US$ 35.41 (Var: - 3.78%). Volume: 1.61 Millions of shares (daily MA: 989K). Good fall with nice volume. Next stop around US$ 33.00. Tuesday's biggest gaining and declining stocks.

Alpha Natural Resources (ANR).- Price: US$ 19.22 (Var: - 2.58%). Volume: 11.78 Millions of shares (daily MA: 11.47M). One bad day but its oversold. Some analysts think ANR has huge upside potential.

Free Down Trend Stock Picks includes three stocks that have experienced daytime significant price falls. These stocks have been selected from a list includes stocks that have shown the worst performance of the last 52 weeks.This means these are stocks with a medium-term downward trend.

Acme Packet Inc. (APKT).- Price: US$ 32.32 (Var: -4.66%). Volume: 3.01 Millions of shares (daily MA: 3.65M). Good fall but its oversold. Will Acme Packet disappoint Analysts next Quarter?

Devri Inc. (DV).- Price: US$ 35.41 (Var: - 3.78%). Volume: 1.61 Millions of shares (daily MA: 989K). Good fall with nice volume. Next stop around US$ 33.00. Tuesday's biggest gaining and declining stocks.

Alpha Natural Resources (ANR).- Price: US$ 19.22 (Var: - 2.58%). Volume: 11.78 Millions of shares (daily MA: 11.47M). One bad day but its oversold. Some analysts think ANR has huge upside potential.

Free Down Trend Stock Picks includes three stocks that have experienced daytime significant price falls. These stocks have been selected from a list includes stocks that have shown the worst performance of the last 52 weeks.This means these are stocks with a medium-term downward trend.

Free Stock Picks with Up Trend: DPZ -SLXP - ACHN

Yesterday, the market went up again. And many stocks followed the same path. The important thing is to see good stocks. With solid fundamentals and nice pattern of prices to support their rise. That's the kind of stocks that we include in this list. Good candidates to take long positions. Some of these, we present here every day. Next, we show three of them. All are good candidates to take long positions.

Dominos Pizza Inc. (DPZ).- Price: US$ 38.82 (Var: +15.74%). Volume: 5.82 Millions of shares (daily MA: 629K). Very good advance with huge volume. DPZ posting one of largest volume increase.

Salix Pharmaceuticals Ltd. (SLXP).- Price: US$ 49.87 (Var: +8.08%). Volume: 3.02 Millions of shares (daily MA: 654K). SLXP advance after 4Q profit beats estimates. Nice advance. Its ready to breakout..

Achillion Pharmaceuticals Inc. (ACHN).- Price: US$ 10.90 (Var: + 3.42%). Volume: 1.02 Millions of Shares (daily MA: 1.99M). One day reversal but the volume was low.

Free Up Trend Stock Picks includes three stocks that have experienced daytime significant price Hikes. These stocks have been selected from a list includes stocks that have shown the best performance of the last 26 weeks.This means these are stocks with a medium-term upward trend.

Dominos Pizza Inc. (DPZ).- Price: US$ 38.82 (Var: +15.74%). Volume: 5.82 Millions of shares (daily MA: 629K). Very good advance with huge volume. DPZ posting one of largest volume increase.

Salix Pharmaceuticals Ltd. (SLXP).- Price: US$ 49.87 (Var: +8.08%). Volume: 3.02 Millions of shares (daily MA: 654K). SLXP advance after 4Q profit beats estimates. Nice advance. Its ready to breakout..

Achillion Pharmaceuticals Inc. (ACHN).- Price: US$ 10.90 (Var: + 3.42%). Volume: 1.02 Millions of Shares (daily MA: 1.99M). One day reversal but the volume was low.

Free Up Trend Stock Picks includes three stocks that have experienced daytime significant price Hikes. These stocks have been selected from a list includes stocks that have shown the best performance of the last 26 weeks.This means these are stocks with a medium-term upward trend.

Bernanke Preview: Time to Exit Crisis Mode Says Paulsen

By Matt Nesto | Breakout

When Federal Reserve Chairman Ben Bernanke makes his way to Capitol Hill for two days of testimony on Wednesday and Thursday, he better be ready to appease both sides of the aisle --those who believe in a sustainable economic recovery and those who still fear the possibility of recession. The man behind our uber-timid monetary policy, the acronym "QE" (quantitative easing), and the visionary who predicted key interest rates will stay near zero through 2014, has a growing dossier of improving economic data to contend with that contradicts his nervous policy stance.

The Fed chief typically faces his fair share of grilling at these semi-annual Congressional events, but this week Wall Street will be on high alert for any signs that Bernanke is changing his mind.

"They need to get out of that crisis mindset," says Jim Paulsen, chief investment strategist at Wells Capital Management, who thinks an about-face on the policy front is overdue. "I mean, do you really think we'd be worrying about Greece in this country if we had a legitimate crisis to worry about? I don't think you can any longer argue that the U.S. economy needs crisis policy."... read more.

Medium Term Growth Portfolio

The Medium Term Growth Portfolio (MTGP) continued to increase its profitability. From the review of the portfolio, it has been shown that all stocks that are part of MTGP are in position to continue to show good returns. According to their technical characteristics, continue to be "top stocks picks". Yesterday, the market showed signs of life during the early hours. Volatility was very high, noticing a great battle between bulls and bears. However, afternoon, the market was almost flat. Nevertheless, he noticed a certain rotation of stocks across sectors. This could bring major changes in the following days.

Stock Tips for Today: Priceline.com Inc. (PCLN)

Hello my Investors, Traders and Reader Friends. Stock Trading. That seems to be the name of the game. Yesterday, the market closed with mixed results. The DJ-30 fell slightly and the SP-500 and the Nasdaq rose slightly. This means... nothing happened. But behinds this "flat market" hide some important issues. On the one hand, the market opened almost 1% below the previous close. The initial volumes were very high. Everything seemed that it would be a negative day. And possibly, the start of a generalized correction. However, from 10 in the morning, the market began to rise. And do not stop until noon. By then, had recovered all the losses. Was perceived enthusiasm. However, from that moment, the market was very quiet. Suspiciously quiet. Below this, be hidden a process of rotation of stocks across sectors. If this rotation is consolidated in the followings days, we will see major changes in the prices of many stocks. Very good opportunities are present in front of our eyes. Our Stock Picks System has identified a large number of stocks that have been consolidating their prices during the last months. And now they are ready to make major breakouts and restart the way up. This is critical time. It is convenient don't take action as these stocks before the break. It is reasonable to wait for now and take action as these stocks jump from its price bases. Meanwhile, I present you a stock that has already made his break. It is Priceline.com Inc. (PCLN). This stock closed yesterday at US$ 591.54, up 0.19% on the previous day. Its volume was 1.9 millions of shares, almost double the daily average. PCLN has a Market Cap. of US$ 29.45 Billions, P/E of 31.30 and a EPS of 18.90. It also has 49.78 millions of shares, of which is 95% by institutional investors. The most remarkable aspect of this stock is their breakout. That, because represents a jump of a price base starting in May of last year. That is, after a consolidation of nine months This would put this stock in a position to initiate a significant price increase.

5 Stocks Set to Soar off Bullish Earnings

WINDERMERE, Fla. (Stockpickr) -- Short-sellers hate being caught short a stock that produces bullish earnings results. When this happens, we often see tradable short-squeeze develop as the bears rush to cover their positions to avoid big losses. Even the best short-sellers know that it's never a great idea to stay short once a bullish earnings report kicks off a big short-covering rally.

This is why I scan the market for heavily shorted stocks that are about to report earnings. You only need to find a few of these stocks in a year to help enhance your portfolio returns -- the gains become so outsized in such a short timeframe that your profits add up quickly.

That said, let's not forget that stocks are heavily shorted for a reason, so you have to use trading discipline and sound money management when playing earnings short-squeeze candidates. It's important that you don't go betting the farm on these plays and that you manage your risk accordingly. Sometimes the best trade is to wait for the stock to break out following the report before you jump in to profit off a short-squeeze. This way, you're letting the trend emerge after the market has digested all of the news... read more.

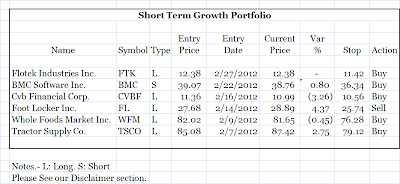

Short Term Growth Portfolio

The Short Term Growth Portfolio, continues to show a great performance. Yesterday, decided to sell one of its components: Foot Locker Inc. (FL). This stock generated a return of 4.37% in just 13 days. Also incorporated in this portfolio to Flotek Industries Inc. (FTK), through a Long Position.

Free Stock Picks with Up Trend: NLST - FTK - CLNE

Yesterday, many of the stocks that rose in price, behaved as candidates for swing trading. This means that out of a short-term downward trend, and continued his way up. Our stock picks system, detected 31 stocks that rose in price with good patterns. This, notwhitstanding at the end of the day, the market did not close so positive. In our effort to show them, our best stock picks, we have reviewed thousands of them. Some of these, we present here every day. Next, we show three of them. All are good candidates to take long positions.

Netlist Inc. (NLST).- Price: US$ 3.59 (Var: +9.45%). Volume: 488.373 shares (daily MA: 574K). Good advance but the volume was low. NLST has been included in the list of 5 stocks under US$10 poised for big upside.

Flotek Industries Inc. (FTK).- Price: US$ 12.38 (Var: +8.03%). Volume: 2.87 Millions of shares (daily MA: 1.6-M). Continues to rise. Next stop around US$ 13.50. Its ready to buy.

Clean Energy Fuels Corp. (CLNE).- Price: US$ 20.13 (Var: + 7.42%). Volume: 4.72 Millions of Shares (daily MA: 1.62M). Nice advance with very high volume. New high.

Free Up Trend Stock Picks includes three stocks that have experienced daytime significant price Hikes. These stocks have been selected from a list includes stocks that have shown the best performance of the last 26 weeks.This means these are stocks with a medium-term upward trend.

Netlist Inc. (NLST).- Price: US$ 3.59 (Var: +9.45%). Volume: 488.373 shares (daily MA: 574K). Good advance but the volume was low. NLST has been included in the list of 5 stocks under US$10 poised for big upside.

Flotek Industries Inc. (FTK).- Price: US$ 12.38 (Var: +8.03%). Volume: 2.87 Millions of shares (daily MA: 1.6-M). Continues to rise. Next stop around US$ 13.50. Its ready to buy.

Clean Energy Fuels Corp. (CLNE).- Price: US$ 20.13 (Var: + 7.42%). Volume: 4.72 Millions of Shares (daily MA: 1.62M). Nice advance with very high volume. New high.

Free Up Trend Stock Picks includes three stocks that have experienced daytime significant price Hikes. These stocks have been selected from a list includes stocks that have shown the best performance of the last 26 weeks.This means these are stocks with a medium-term upward trend.

Buffett Owns Up to Mistakes

The Street

NEW YORK (TheStreet) -- With a nickname like "the Oracle of Omaha," it is possible to forget that Warren Buffett has made his fair share of mistakes during his multi-decade investing career. In this year's Berkshire Hathaway(BRK.A_) letter to shareholders, however, the billionaire investor took time to present some of his most recent flubs, reminding investors, fans, and market commentators that not even the most famous and successful of investors are immune to the market's challenges.

Given his success and charisma, it is not surprising that Buffett's highlights are well documented. In addition to his successes, though, fans and followers also keep close tabs on the investor's slip-ups. For example, many are well aware of the investor's past troubles with the airline industry. Although he has managed to successfully turn around NetJets in recent years, the staggering loss he was forced to write off from his bad bet on U.S. Airways remains a smudge on his record.

|

Energy is another industry the investor has struggled with in the past. While he has long maintained exposure to oil and gas companies, Warren Buffett famously doubled down in 2008 on ConocoPhillips(COP_)just as oil prices were peaking. The bet quickly went ...read more.

4 Dividend Darlings

Investopedia

Any long-term investor can appreciate the value of a dividend. Over time, the dividend becomes a bigger factor in the total return of a company. Mathematically speaking, assume a share of stock is bought for $10 and yields 3%. Five years later the shares trade for $20 and yield the same 3% due to increased dividend payments. For the investor who purchased shares at $10, her effective yield is now 6%. Over the course of 10 years or more, the dividend effect on your portfolio becomes truly significant.

Investopedia Markets: Explore the best one-stop source for financial news, quotes and insights.

Dividends Matter

Dividends do matter but only when they can be counted on to be paid consistently. Often, an abnormally high yield is a market signal that a dividend may be temporary. Yet the market is not always right. During the recession, quality energy master limited partnerships were yielding 15% and up because investors were selling shares as the price of oil and natural gas was declining (dividend yields rise when stock prices decline and vice versa). Yet energy MLPs had hedged production at energy prices that enabled them to maintain distributions. When investors caught on, shares went soaring... read more.

Any long-term investor can appreciate the value of a dividend. Over time, the dividend becomes a bigger factor in the total return of a company. Mathematically speaking, assume a share of stock is bought for $10 and yields 3%. Five years later the shares trade for $20 and yield the same 3% due to increased dividend payments. For the investor who purchased shares at $10, her effective yield is now 6%. Over the course of 10 years or more, the dividend effect on your portfolio becomes truly significant.

Investopedia Markets: Explore the best one-stop source for financial news, quotes and insights.

Dividends Matter

Dividends do matter but only when they can be counted on to be paid consistently. Often, an abnormally high yield is a market signal that a dividend may be temporary. Yet the market is not always right. During the recession, quality energy master limited partnerships were yielding 15% and up because investors were selling shares as the price of oil and natural gas was declining (dividend yields rise when stock prices decline and vice versa). Yet energy MLPs had hedged production at energy prices that enabled them to maintain distributions. When investors caught on, shares went soaring... read more.

Free Stock Picks with Down Trend: YPF - NIHD - IBN

The market closed with mixed results on Monday. Our system continues to find good stocks picks. In this case, to take short positions. The stock trade was presented yesterday in a very interesting way. After starting the day with very significant losses, the major indices started a recovery. The DJ-30 closed with slight losses, but the SP-500 and the Nasdaq ended with gains. This behavior can generate a good return in the stock investment. Next, you will find three "hot stock picks", three good candidates for short positions.

YPF Sociedad Anonima (YPF).- Price: US$ 31.15 (Var: -5.61%). Volume: 1.65 Millions of shares (daily MA: 1.32). Good fall. Start a new leg down. Despite this fall, YPF follows within high yielding Global Oil Stocks.

Nii Holdings (NIHD).- Price: US$ 19.27 (Var: - 4.84%). Volume: 7.12 Millions of shares (daily MA: 3.39M). Continues to fall after our comment of the last two days. Nii downgraded by Barclays.

ICICI Bank Ltd. ADS. (IBN).- Price: US$ 36.06 (Var: - 4.10%). Volume: 3.64 Millions of shares (daily MA: 3.01M). Breakdown the Simple Moving Average 200 days. Expensive oil hurts Indian shares.

Free Down Trend Stock Picks includes three stocks that have experienced daytime significant price falls. These stocks have been selected from a list includes stocks that have shown the worst performance of the last 52 weeks.This means these are stocks with a medium-term downward trend.

YPF Sociedad Anonima (YPF).- Price: US$ 31.15 (Var: -5.61%). Volume: 1.65 Millions of shares (daily MA: 1.32). Good fall. Start a new leg down. Despite this fall, YPF follows within high yielding Global Oil Stocks.

Nii Holdings (NIHD).- Price: US$ 19.27 (Var: - 4.84%). Volume: 7.12 Millions of shares (daily MA: 3.39M). Continues to fall after our comment of the last two days. Nii downgraded by Barclays.

ICICI Bank Ltd. ADS. (IBN).- Price: US$ 36.06 (Var: - 4.10%). Volume: 3.64 Millions of shares (daily MA: 3.01M). Breakdown the Simple Moving Average 200 days. Expensive oil hurts Indian shares.

Free Down Trend Stock Picks includes three stocks that have experienced daytime significant price falls. These stocks have been selected from a list includes stocks that have shown the worst performance of the last 52 weeks.This means these are stocks with a medium-term downward trend.

G20 to Europe: Show us the money

Reuters

RELATED QUOTES

| Symbol | Price | Change |

|---|---|---|

| LEHMQ.PK | 0.0246 | +0.00 |

By Gernot Heller and Glenn Somerville

MEXICO CITY (Reuters) - Leading economies told Europe it must put up extra money to fight its debt crisis if it wants more help from the rest of the world, piling pressure on Germany to drop its opposition to a bigger European bailout fund.

Euro zone countries pledged on Sunday, at a meeting of finance leaders from the Group of 20 economic powers, to reassess next month the strength of their bailout fund.

This would be "essential input" when it comes for the G20 countries to consider putting more money into the International Monetary Fund's crisis war chest, G20 finance ministers and central bankers said in their final communiqué after two days of meetings here.

"There is broad agreement that the IMF cannot substitute for the absence of a stronger European firewall and the IMF cannot move forward without more clarity on Europe's own plans," U.S. Treasury Secretary Timothy Geithner said... read more.

Purchase Cash Value Life Insurance, or Buy Term and Invest the Difference?

By Christine Benz | Morningstar

Insuring against risk--car accidents, calamities at home, and yes, premature death--is a crucial aspect of the financial-planning process, yet it's one that tends not to get a lot of play on Morningstar.com's investing-centric Discuss forums.

In a recent thread on Morningstar.com, I asked readers to share how they had approached insuring against the latter risk. Had they purchased a low-cost, no-frills term life insurance policy, or had they opted for a more permanent life insurance policy as part of their financial plans?

Readers' responses ran the gamut: Although some were openly disdainful of permanent policies, characterizing them as high-cost and less-than-transparent, others said they have used a combination of term and whole or universal policies and have been satisfied with their decisions. To read the complete thread or share your own approach to life insurance, click here (http://socialize.morningstar.com/NewSocialize/forums/p/299758/3204648.aspx).

BTID All the Way A healthy contingent of posters was unequivocal about using a utilitarian term policy and steering clear of permanent products.

Jnelson6455 advised, "Buy term and invest the difference--BTID--all the way. My agent replaced my whole life policy and for the same money I had been paying I was able to triple my coverage and still have money to save on my own. Cash-value policies are one of the worst products sold to the middle class. Too expensive to get the coverage needed and too many hidden fees to qualify as a good savings vehicle."... read more.

3 Stocks Set To Climb By More Than 25%

SeekingAlpha

I take a closer look at three companies that are favored on the Street, trade at multiples below 10x, and by my calculations have more than 25% upside. They cover diverse industries: healthcare, mining, and financials. Of the three companies, Freeport (FCX) is the favored pick on the Street, given its strong secular trends in gold and leading brand name. I similarly find that Freeport has the strongest upside. Note that all the ratings are sourced from T1 Banker.

Cigna

Cigna (CI) is rated a "buy" and trades at a respective 8.2x and 7.5x past and forward earnings, with a dividend yield of 0.1%.

Consensus estimates for Cigna's EPS forecast that it will grow by 4.4% to $5.44 in 2012, and then by 11.2% and 14.5% in the following two years. Assuming a multiple of 9.5x and a conservative 2013 EPS of $6.01, the rough intrinsic value of the stock is $57.10, implying 26.5% upside.

The company delivered a strong close to the year, with momentum across all geographies and segments. I am further optimistic about Cigna's ability to unlock revenue synergies from Health Spring in terms of expanding into Medicare... read more.

Subscribe to:

Posts (Atom)