Do you like to follow the buying trends of big money investors? One idea is to compare a stock's recent performance to its institutional buying trends. When they don't match up, there might be more to the story.

We ran a screen on the tech sector for stocks rallying above their 20-day, 50-day, and 200-day moving averages. We then screened for those with significant net institutional selling over the current quarter.

Despite this strong trading performance, institutional investors such as hedge fund managers expect these names to underperform.

Interactive Chart: Press Play to compare changes in analyst ratings over the last two years for the top six stocks mentioned below. Analyst ratings sourced from Zacks Investment Research.

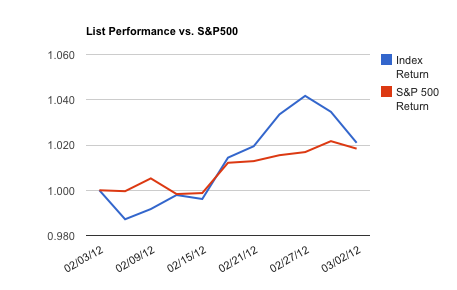

We also created a price-weighted index of the stocks mentioned below, and monitored the performance of the list relative to the S&P 500 index over the last month. To access a complete analysis of this list's recent performance, click here.

Do you think hedge fund managers are calling it right, or do these stocks have more to price in? Use this list as a starting point for your own analysis.

1. Advanced Energy Industries, Inc. (AEIS): Designs, manufactures, sells, and supports...read more.

No comments:

Post a Comment